If you are a real estate investor or simply someone looking for a great deal on a property, exploring off-market real estate deals can be a highly profitable avenue worth exploring. Off-market properties refer to properties that are not listed on the Multiple Listing Service (MLS) or advertised publicly. These deals often present hidden opportunities that can yield significant dividends if approached strategically. In this post, I will outline some effective strategies to help you find off-market real estate deals.

1. Networking: Establishing and maintaining a strong network is crucial when it comes to finding off-market real estate deals. Attend local real estate networking events, join investment clubs, and engage with industry professionals such as realtors, lenders, contractors, and property managers. Let them know about your investment goals and ask if they are aware of any off-market opportunities. Some of the best deals are often passed along through word-of-mouth referrals.

2. Direct Marketing: Take an active approach and initiate direct marketing campaigns. This can include sending out personalized letters or postcards to property owners in areas you’re targeting. You can also utilize online platforms to find contact information for property owners and reach out to them directly via email or phone. Craft compelling messages that highlight your interest in purchasing their property off-market, ensuring that you address their unique pain points and motivations for selling.

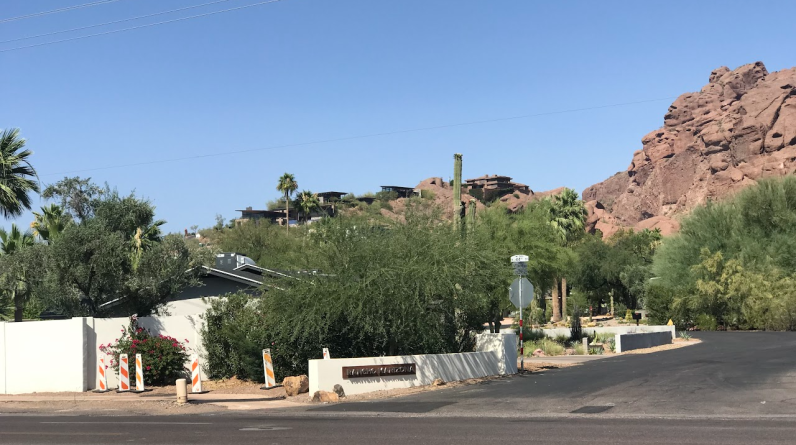

3. Drive For Dollars: Get behind the wheel and start driving around neighborhoods you are interested in. Look for properties that show signs of distress, such as overgrown lawns, boarded-up windows, or “For Sale By Owner” signs. These indicators may suggest that the property owner is motivated to sell and could be open to an off-market deal.

4. Probate And Divorce Filings: Monitor local probate and divorce filings as they often lead to real estate deals. When someone passes away or a couple goes through a divorce, there is often a need to liquidate assets, including real estate. Keep an eye on these filings and reach out to the parties involved to express your interest in purchasing their property.

5. Public Records And Tax Delinquencies: Public records can be a goldmine of information regarding off-market properties. Check for tax delinquencies, notices of default, or lis pendens (lawsuit pending) filings. These properties could potentially be distressed and may indicate an opportunity for a motivated seller who is open to negotiation.

6. Real Estate Auctions: Attend local real estate auctions, both online and in-person. These events often see distressed properties being sold off, including foreclosures, bank-owned properties, or tax lien sales. Be prepared and set a budget beforehand to prevent overbidding.

7. Wholesalers And Bird Dogs: Network with local wholesalers who specialize in finding off-market deals. Wholesalers act as intermediaries, finding distressed properties and passing them on to investors for a fee. Similarly, bird dogs are individuals who actively seek out off-market opportunities in exchange for a finder’s fee. Developing relationships with these professionals can provide you with a consistent stream of potential off-market real estate deals.

In Conclusion: finding off-market real estate deals requires a proactive mindset and a combination of strategies. Networking, direct marketing, driving for dollars, monitoring public records, attending auctions, and partnering with wholesalers or bird dogs can all increase your chances of discovering lucrative off-market opportunities. Remember that persistence and a strong understanding of the local market are key to successfully uncovering hidden gems that others may overlook.

Want to become a real estate investing Partner with me? To learn more simply go to the link below! https://reimrcharles.net/rei-team